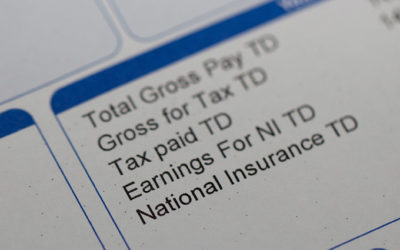

The National Insurance levy starts in April 2022 – time to prepare your payroll and accounting

It’s almost two years since the start of the pandemic which has had a major impact on our working life; business, personal, and public finances – and health.

Reverse charge in the building and construction industry

When is the reverse charge VAT in construction? The way VAT is collected in the building and construction industry was due to change on 1 October 2020 but has now been delayed until 1 March 2021 due to the Coronavirus pandemic. Additionally, the Government has also...

WinPay v7.09 delayed

The 2020 Budget was originally scheduled to take place on 6 November 2019, but the snap general election held on 12 December 2019 postponed this. We are still awaiting the details of the Budget, which is now due to be held on 11 March 2020. This is considerably later...

P60 Stationary

Need P60 stationary for the end of tax year? Please order for FREE from the HMRC website. Compact Software is no longer supplying stationary. Visit: http://www.hmrc.gov.uk/gds/payerti/forms-updates/forms-publications/onlineorder.htm

Preparing for Making Tax Digital

What is Making Tax Digital? Making Tax Digital will change the way your business updates the HMRC regarding your company taxes. The first of these changes will come into play in April 2019 with Making Tax Digital for VAT. From April 2019, VAT-registered businesses...